In this journal entry, we can debit the additional paid-in capital account only if there is an available balance (the credit side). However, if there is no available balance in the additional paid-in capital account, we will need to debit the retained earnings account instead. The most mysterious term on a set of financial statements might well be “par value.” The requirement for a par value to be set was created decades ago in connection with the issuance of stock.

- The credit entry to the Class A Share Application reflects the liability the company also holds.

- Once the Board approves the transaction and the paperwork is complete, the ABC accounts team would prepare the following journal entry.

- The company can make the journal entry for the issuance of common stock for cash at par value by debiting the cash account and crediting the common stock account.

- Kellogg reports that one billion shares of common stock were authorized by the state of Delaware but only about 419 million have actually been issued to stockholders as of the balance sheet date.

Authorized Share

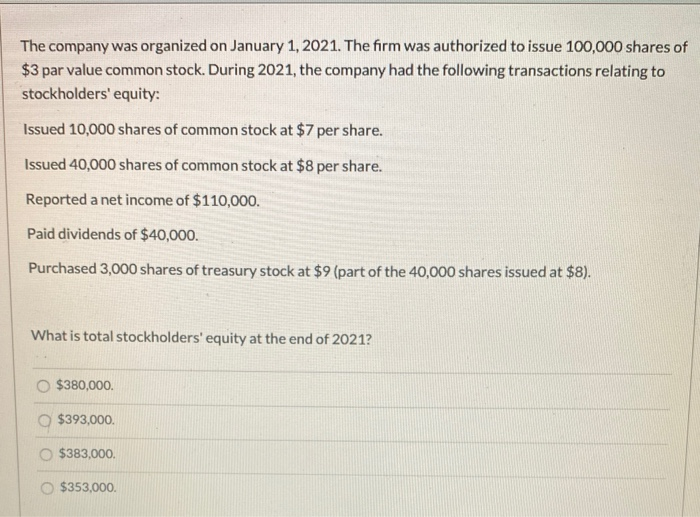

This guide provides an in-depth look at the journal entries required for stock issuances, stock dividends (both small and large), and stock splits, with clear examples to aid understanding. “Issue” means to sell the shares of stock for the first time. If the company issues only one type of stock, it is common stock.

Reporting Treasury Stock for Nestlé Holdings Group

If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up. However, if that value is not available, the fair value of the asset or service is used. Shares with a par value of $5 have traded (sold) in the market for more than $600, and many $100 par value preferred stocks have traded for considerably less than par.

Issuance of common stock at price higher than par value

Additionally, even though some jurisdictions allow the issuance of the common stock below its par value, such activity is usually very rare. In this case, we will record the land in the balance sheet as $50,000 ($10,000 x 5,000 shares) even though the land was put on sale for a different price (e.i. $60,000). This is due to the due to the share price on the capital market is considered to be more reliable than the asking price of the land.

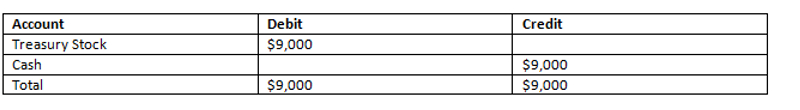

As a contra equityaccount, Treasury Stock has a debit balance, rather than the normalcredit balances of other equity accounts. In substance, treasury stockimplies that a company owns shares of itself. Treasury shares do not carrythe basic common shareholder rights because they are notoutstanding. Dividends are not paid on treasury shares, theyprovide no voting rights, and they do not receive a share of assetsupon liquidation of the company.

When a company issues common shares, it is effectively selling ownership stakes in the company to the investors who purchase the shares. In this journal entry, the total expenses on the income statement and the total equity on the balance sheet increase by the same amount. The expense amount in this journal entry is the fair value of the service that the corporation receives in exchange for giving up the shares of the common stock.

In addition to the non-cash asset, we may also issue the common stock in exchange for the service instead. In this case, the debit side of the journal entry will be the expense amounting to the cost or the fair value of the service that needs to be charged to the income statement instead. The line items used for its reporting in the statement of cash flows are “issuance freshbooks vs nonprofit treasurer 2021 of common stock,” if the common shares are sold, and “issuance of preferred stock,” if the preferred shares are sold. Any finance received in excess of the share’s par value ends up on the share premium account. This account includes any compensation received over that value. If companies issue shares at below the par value, this account will also get impacted.

However, if the share price is not available on the market, the cost of the non-cash asset will be used instead. A stock split increases the number of shares outstanding by a specific ratio and proportionally reduces the par value per share. Unlike stock issuances or stock dividends, no journal entry is required for stock splits because they do not impact total equity—only the structure of shares and par value changes. Pickle, Inc. has authorized 1,000,000 shares of common stock and has issued 200,000 of them to shareholders. Pickle repurchased 60,000 shares from the shareholders during the year and that was the only transaction affecting common stock.

Leave A Comment