Psst—to stay organized and make recording easier, remember to keep your personal finances and your business finances separate. The accrual-based accounting method works better with double-entry bookkeeping, so it’s best for more complex business structures or businesses that keep inventory or sell goods. You record transactions as soon as they’re invoiced or billed, even if the money isn’t in your metaphorical pockets yet. As businesses grow, it becomes easier to let small activities slip.

Remember Your Tax Deadlines

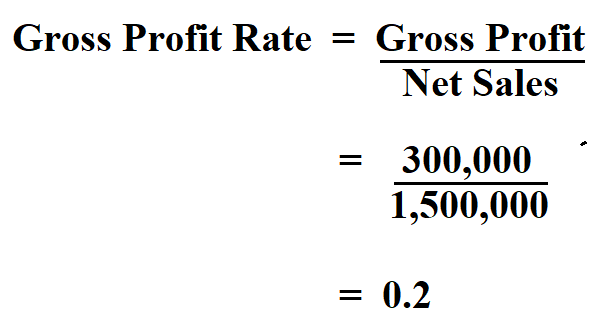

Maintaining bookkeeping tasks is essential for the stability and success of small businesses. With so many moving pieces (including assets and liabilities, and income and expenses), small business owners must stay summary of gross profit percentage. abstract on top of it all. Another type of accounting method is the accrual-based accounting method. This method records both invoices and bills even if they haven’t been paid yet. This is a highly recommended method because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth.

Learn When It’s Time to Outsource

Having a solid overview of your bookkeeping and accounting reports gives you a good enough start for cash flow projections for the following months. A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly. After you have a bookkeeping system in mind, the next step is to pick an accounting software. Spreadsheets, such as Microsoft Excel, can be used for simple bookkeeping. More net working capital definition commonly, entrepreneurs use comprehensive accounting software like QuickBooks that can handle a larger volume of transactions and provide a deeper analysis.

What you need to set up small business bookkeeping

You might want to begin with Bookkeeping Basics or Intuit Bookkeeping, both offered by Intuit on Coursera. You can also learn how to use Excel to keep your books or create your business budget with Google sheets. If you’re paying employee taxes or sales tax, you’ll need to prepare a quarterly report for remitting payments to the IRS and other required taxing agencies. If you decide to grow your business or sell to consumers, you’ll need to transition to the accrual method to meet generally accepted accounting principles (GAAP). This can be challenging if you’ve operated under the cash method for a long time, but it will most likely be more efficient.

Don’t forget to save money for office supplies, inventory, maintenance, and repairs. Budget your business for the future to avoid unnecessary stress and surprises. Yearly rises and falls in the business finances and budget helps allocate enough resources and make the right decisions. If you check regularly (and compare to prior months’ numbers), it’s easier to make adjustments, so you are neither short nor overloaded. If you’re managing inventory, set aside time to reorder products that sell quickly and identify others that are moving slowly and may have to be marked down or written off. Business bank reconciliation makes it easier to discover and correct errors or omissions—either by you or the bank—in time to correct them.

Whether it’s a lack of interest or knowledge, many businesses outsource this process to a professional bookkeeper to ensure accurate and healthy finances all around. Recording can be pretty time-consuming (especially if you’ve been putting it off), which is where accounting software like Wave’s can help. Under single-entry, journal entries are recorded once, as either an expense or income.

- Not sure where to start or which accounting service fits your needs?

- With the first, you’ll create a receipt for every cash payment you receive.

- No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

- This can be as simple as a statement showing your current cash position, expected upcoming cash receipts, and expected cash payments for this period.

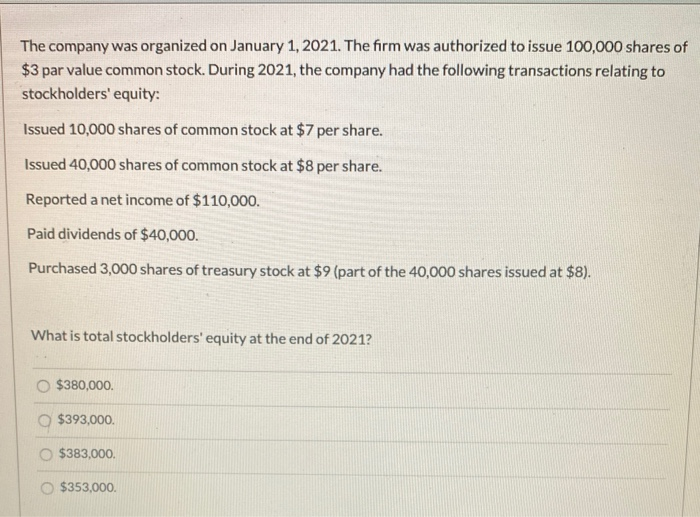

- Generally, if your assets are greater than your liabilities, your business is financially stable.

Check your inventory

On top of that, you need the data used in bookkeeping to file your taxes accurately. Super pumped up about bookkeeping now and looking for something to get started on right away? You’ll analyze your financial documents to get key insights into your business’s health, which will help you make smart business decisions going forward. To prepare a profit and loss statement, first include all the revenue your business made during that period. Finally, subtract your total expenses from your total revenue dividends: definition in stocks and how payments work to get your bottom line. You could go with one of dozens of popular cloud accounting solutions, like QuickBooks, Xero or Wave.